- Name Approval & DSC 1-2

- Drafting MOA & AOA documents with ROC 3 -5 Days

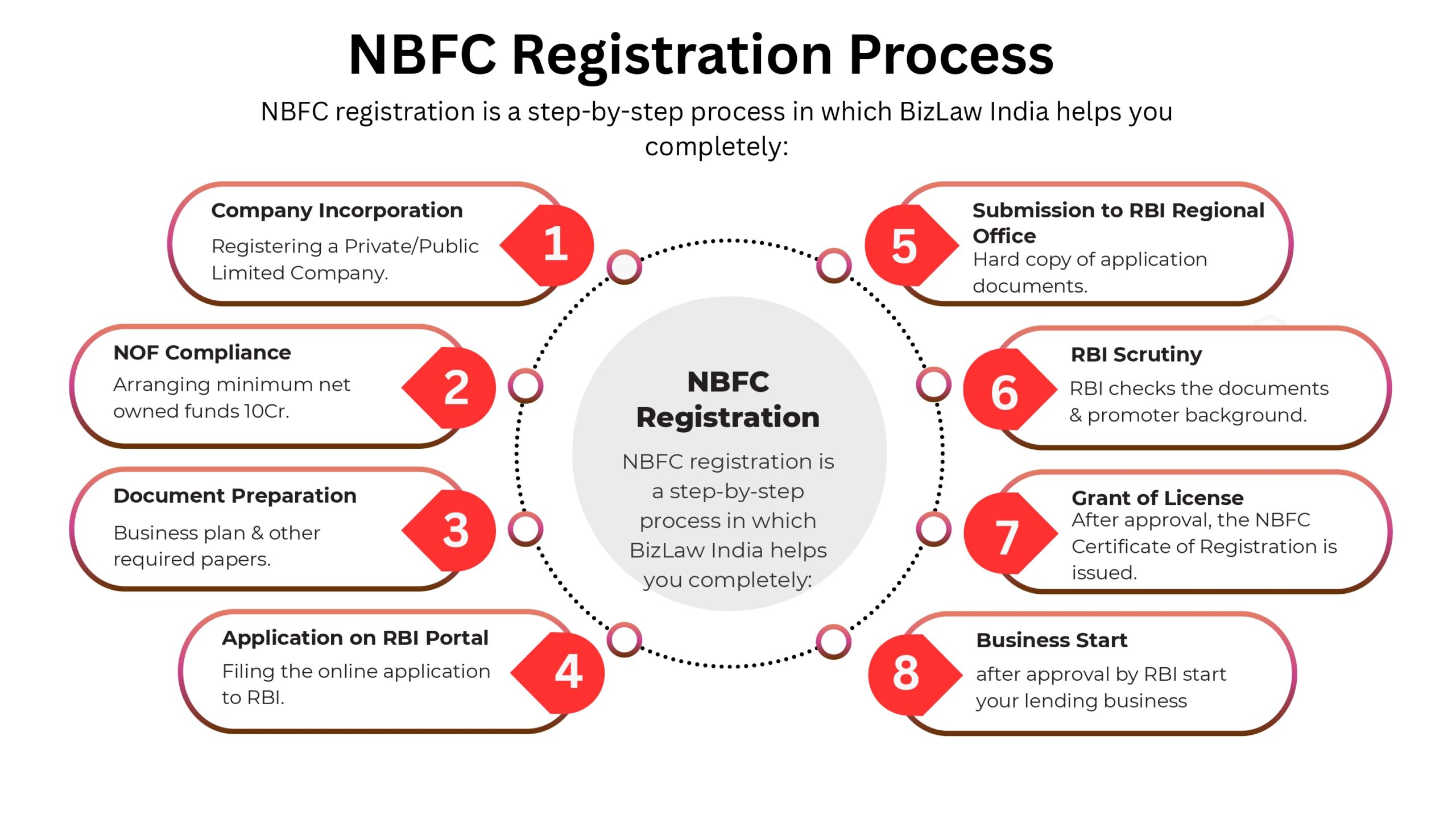

NBFC Registration in India – Process, Eligibility & Compliance

India’s financial sector is evolving day by day, and non-banking financial companies (NBFCs) are playing a significant role in it. If you want to enter the financial sector, NBFC registration provides your business with legal recognition and new opportunities for growth.

- +91-7018468373

- +91-7018468373

- help@bizlawindia.com

Request A Call Back

Rated at 4.8/1200+ Happy Reviews

NBFC Registration in India – Process, Eligibility & Compliance

India’s financial sector is evolving day by day, and non-banking financial companies (NBFCs) are playing a significant role in it. If you want to enter the financial sector, NBFC registration provides your business with legal recognition and new opportunities for growth.

At BizLaw India, we provide you with end-to-end NBFC registration support – from document preparation to RBI filing to license approval.

What is an NBFC?

An NBFC is a company that provides loans and advances, engages in the acquisition of shares, bonds, and debentures, and offers financial leasing or hire purchase services – but it cannot accept demand deposits.

Simply put, an NBFC is a financial institution that is regulated under the RBI and provides credit services to people without being a bank.

Benefits of Registering an NBFC

Access to Formal Credit Market

Your business gets a legal license which allows you to provide financial services easily.

Wider Business Opportunities

There is scope to work in multiple models like loan, investment, leasing, microfinance etc.

Legal Recognition & Trustworthiness

After getting registered with RBI, trust of investors and clients is built.

Fundraising & Expansion

It becomes easy to raise capital from banks, investors and institutions.

Types of NBFCs in India

- Asset Finance Company (AFC)

- Investment Company (IC)

- Loan Company (LC)

- Infrastructure Finance Company (IFC)

- Micro Finance Institution (MFI)

- Housing Finance Company (HFC)

- Core Investment Company (CIC)

- Peer-to-Peer Lending NBFC (P2P)

- Account Aggregator NBFC

Eligibility Criteria for NBFC Registration

Company Types

The company should be a Private Limited or Public Limited Company (under the Companies Act, 2013).

Minimum NOF

Minimum Net Owned Fund (NOF) requirement is ₹10 Crore.

Qualifying Directors

Directors must have experience and qualifications in the finance sector.

Criteria Of Fitness

Promoters and directors should meet RBI’s “fit & proper” criteria.

Documents Required for NBFC Registration

For NBFC registration, you need the following documents:

- Certificate of Incorporation (COI)

- MOA & AOA of company

- Board Resolution authorizing NBFC business

- Detailed 5-year Business Plan

- Net worth certificate from CA

- Directors’ KYC, PAN, Aadhaar & qualification proofs

- Bank account details & balance confirmation

Why Choose BizLaw India for NBFC Registration?

For NBFC registration, you need the following documents:

- Expert Team – Our lawyers and CAs have direct experience in NBFC deals and RBI compliances.

- End-to-End Guidance – A one-stop solution from company incorporation to license approval.

- Fast Documentation Support – Every document is properly drafted and filed.

- 100% Compliance Assurance – Safe and smooth registration under RBI guidelines.

Contact Us for NBFC Registration Assistance

NBFC registration is a professional and technical process in which it is essential to complete every step correctly. BizLaw India is your trusted partner that will help you obtain hassle-free RBI license approval.

FAQs about NBFC Software

A Non-Banking Financial Company (NBFC) is a financial institution that provides loans, advances, investments, leasing, and other credit services, but it cannot accept demand deposits like banks.

Running a financial business without RBI approval is illegal. Registration gives your company legal recognition, customer trust, and opportunities to raise funds.

As per RBI regulations, an NBFC must have a minimum Net Owned Fund (NOF) of ₹10 Crore.

Any Private Limited or Public Limited Company registered under the Companies Act, 2013 can apply for NBFC registration.

On average, the NBFC registration process takes 3–6 months, depending on documentation and RBI’s review.

Some major categories include:

- Asset Finance Company (AFC)

- Loan Company (LC)

- Investment Company (IC)

- Infrastructure Finance Company (IFC)

- Microfinance NBFC (MFI)

- Housing Finance Company (HFC)

- Peer-to-Peer Lending NBFC (P2P)

- Account Aggregator NBFC

No, NBFCs cannot accept demand deposits. They can only provide financial services such as loans, leasing, and investments.

- Certificate of Incorporation (COI)

- Memorandum of Association (MOA) & Articles of Association (AOA)

- Board Resolution

- 5-year Business Plan

- Net Worth Certificate from a CA

- Directors’ KYC & Qualification Proof

- Bank Balance Confirmation

RBI requires a detailed 5-year business plan that shows the proposed operations, financial projections, compliance strategy, and revenue model of the NBFC.

RBI verifies the promoters’ background, capital adequacy, business model, and compliance capacity before granting an NBFC license.